30+ how to make mortgage payments

With each payment you make youll be paying off part of the principal. Heres a simple tip.

Pay Off Your 30 Year Home Loan 6 Years Faster 10 Easy Tips Easy

Web For example lets assume you take an initial mortgage of 240000 on a 300000 purchase with a 20 down payment.

. LawDepot Has You Covered with a Wide Variety of Legal Documents. N 30 years x 12 months per year or 360 payments. Web The general rule is that if you double your required payment you will pay your 30-year fixed rate loan off in less than ten years.

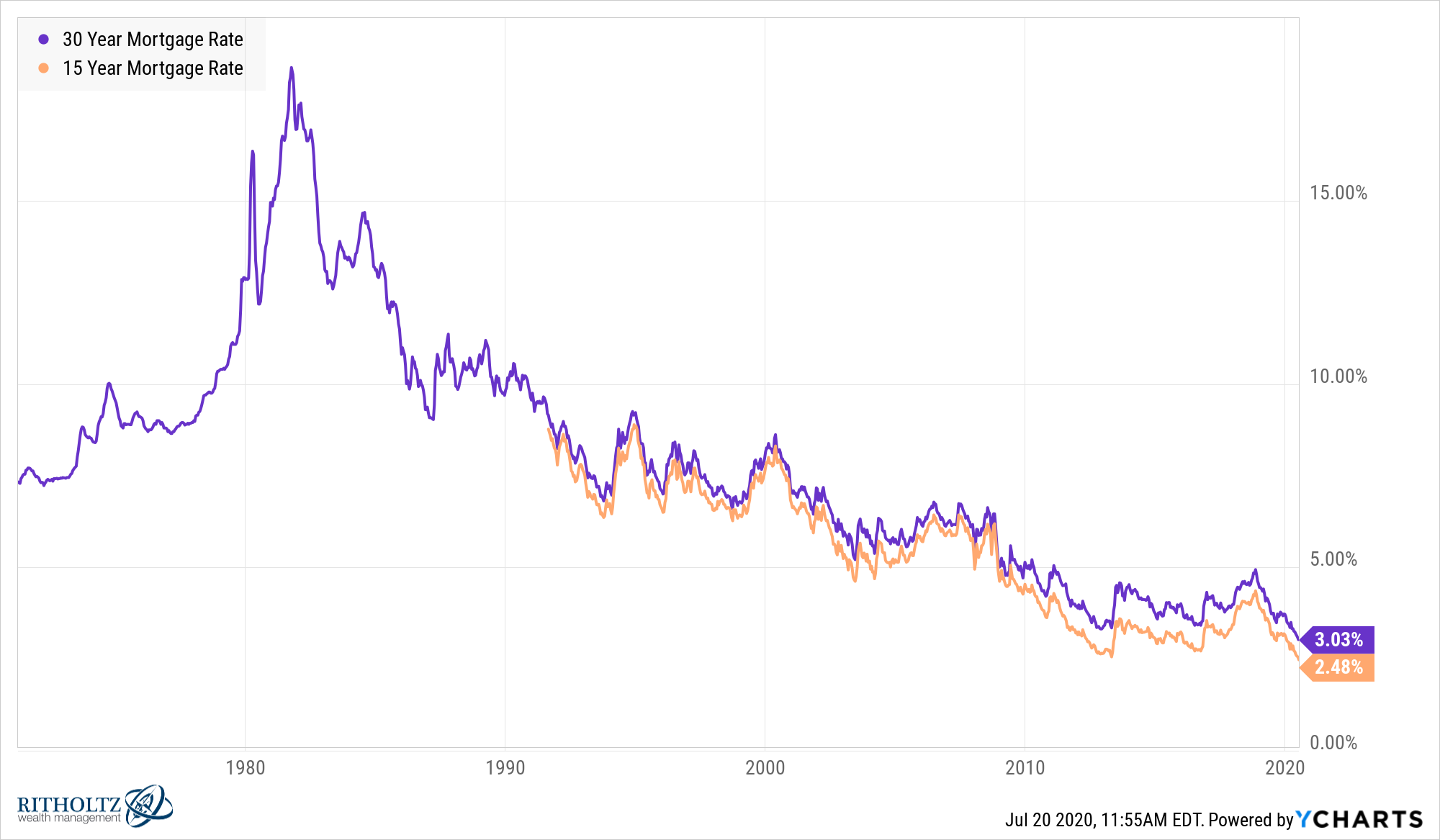

Homeowners spend an average of 284 of their pre-tax income on mortgage payments. The average interest rate for a standard 30-year fixed mortgage is 697 which is a decrease of 16 basis points from seven days. Ad See how much house you can afford.

If you buy a home with a loan for 200000 at 433 percent your monthly payment on a 30. Web Generally speaking the premise of making biweekly mortgage payments is simple. Estimate your monthly mortgage payment.

Principal is the loan amount you initially borrow from a lender to. Ad Calculate Your Monthly Payment with Our Free Online Mortgage Calculator. Web The higher your interest rate and the more youve borrowed the more you could save.

Web If you take out a 30-year fixed rate mortgage this means. Instead of paying once a month you pay half your monthly mortgage amount. Create Your Satisfaction of Mortgage.

Ad Developed by Lawyers. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. How a mortgage calculator helps you Determining what your.

To put this into perspective Ramsey explains that if you take home 5000. But recent data from Todays. Web 30-year fixed-rate mortgages.

Web On a national level US. If you have a 300000 mortgage at 4 for 30 years biweekly payments. Web Using the example of a 200000 mortgage at a 30-year term and 4 interest one extra payment each year can shave four years off the repayment period.

Calculate Your Mortgage Payments With Our Free Mortgage Calculator Now. Web You make regular payments to repay this loan usually monthly. Web And the only way to do that is to understand your home-buying budget and stick to it.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web The most significant factor affecting your monthly mortgage payment is the interest rate.

Make extra payments whenever you can even just a little bit more each month can. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web Biweekly mortgage payments help pay off your loan faster by applying an extra payment to the principal yearly.

Making a mortgage payment online is fast and reliable and if your mortgage is from the same company that you bank with its even. And homeowners in 21 states and Washington DC. Web She uses the example of a 30-year mortgage for 350000 with a 65 percent interest rate.

If you havent been approved for a loan term and interest rate. The amount you borrow is the loan principal. A 100000 mortgage with a 6 percent interest rate.

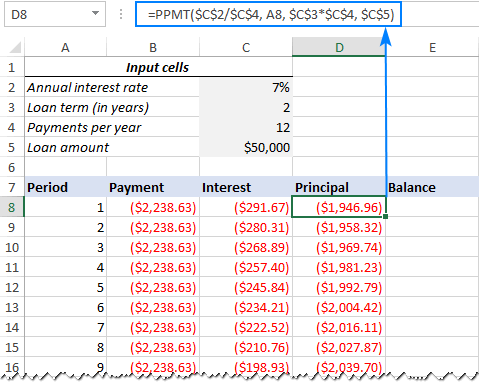

If you were to pay 150 extra toward your principal each month. Web Mortgage payment equation Principal Interest Mortgage Insurance if applicable Escrow if applicable Total monthly payment The traditional monthly mortgage. The basic mortgage payment consists of two components.

Web 4 hours agoIn fact a good rule of thumb is to make sure your total predictable monthly housing costs dont exceed 30 of your take-home pay. Web To help calculate your monthly mortgage payment enter a loan term up to a maximum of 30 years. Web Want to pay off your mortgage even faster.

Web Equation for mortgage payments M P r 1 r n 1 r n - 1 This formula can help you crunch the numbers to see how much house you can afford. Your monthly payment is 107771. Web Online Mortgage Payment.

Find out if biweekly payments are right for you.

Mortgage Rates Are Insanely Low

Could Anyone Help Me Understand Overpaying Nationwide Mortgage Moneysavingexpert Forum

How To Pay Off A 30 Year Mortgage In 15 Years Debt Org

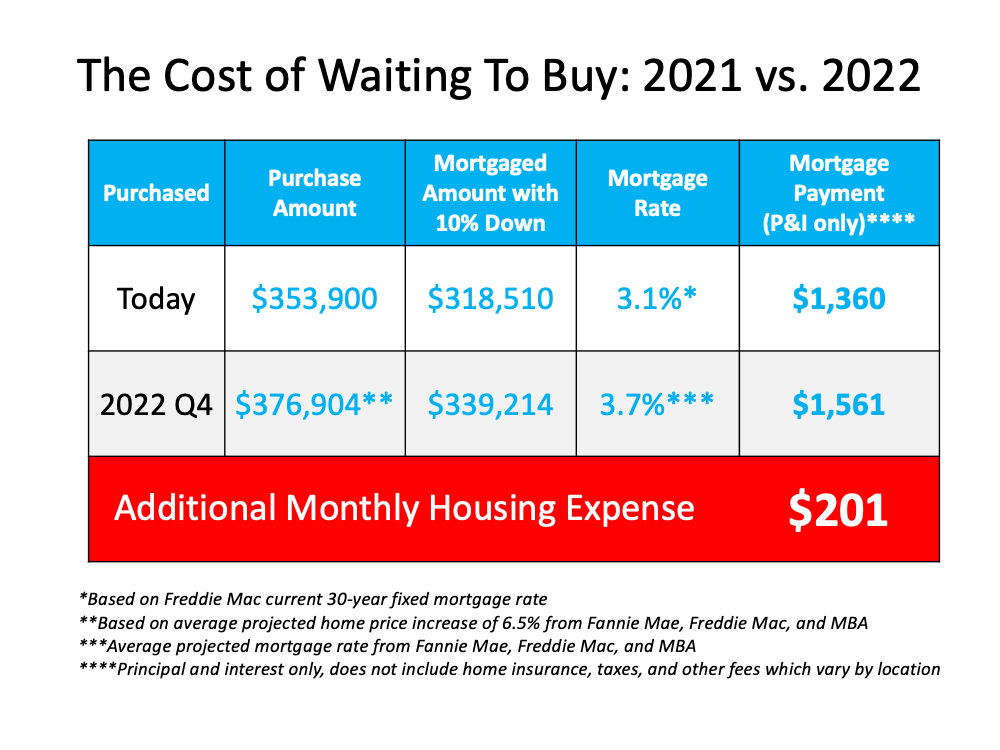

Two Reasons Why Waiting To Buy A Home Will Cost You Very Vintage Vegas Las Vegas Mid Century Modern Homes

Mortgage Guidelines On Late Payments In The Past 12 Months

How To Pay Off A 30 Year Mortgage In 15 Years Debt Org

How Do Late Payments Impact Mortgage Applications Haysto

Can I Get A 30 Year Mortgage In Canada Nesto Ca

Getting A Mortgage The Four C S Of Credit Smart Money Mamas

How To Pay Off A 30 Year Home Mortgage In 5 7 Years 2022 Youtube

Free 6 Sample Mortage Loan Calculator Templates In Pdf

Investor Loan Lisa Legrande Mortgage Loan Officer

Temporary Rate Buydown Calculator Walter Mackelburg Mortgage Loan Officer

Effects Of 15 Vs 20 Vs 25 Down Payments On Long Term Wealth Building Denver Investment Real Estate

Shopping How Much Do You Pay Off Your Mortgage Each Year Big Sale Off 72

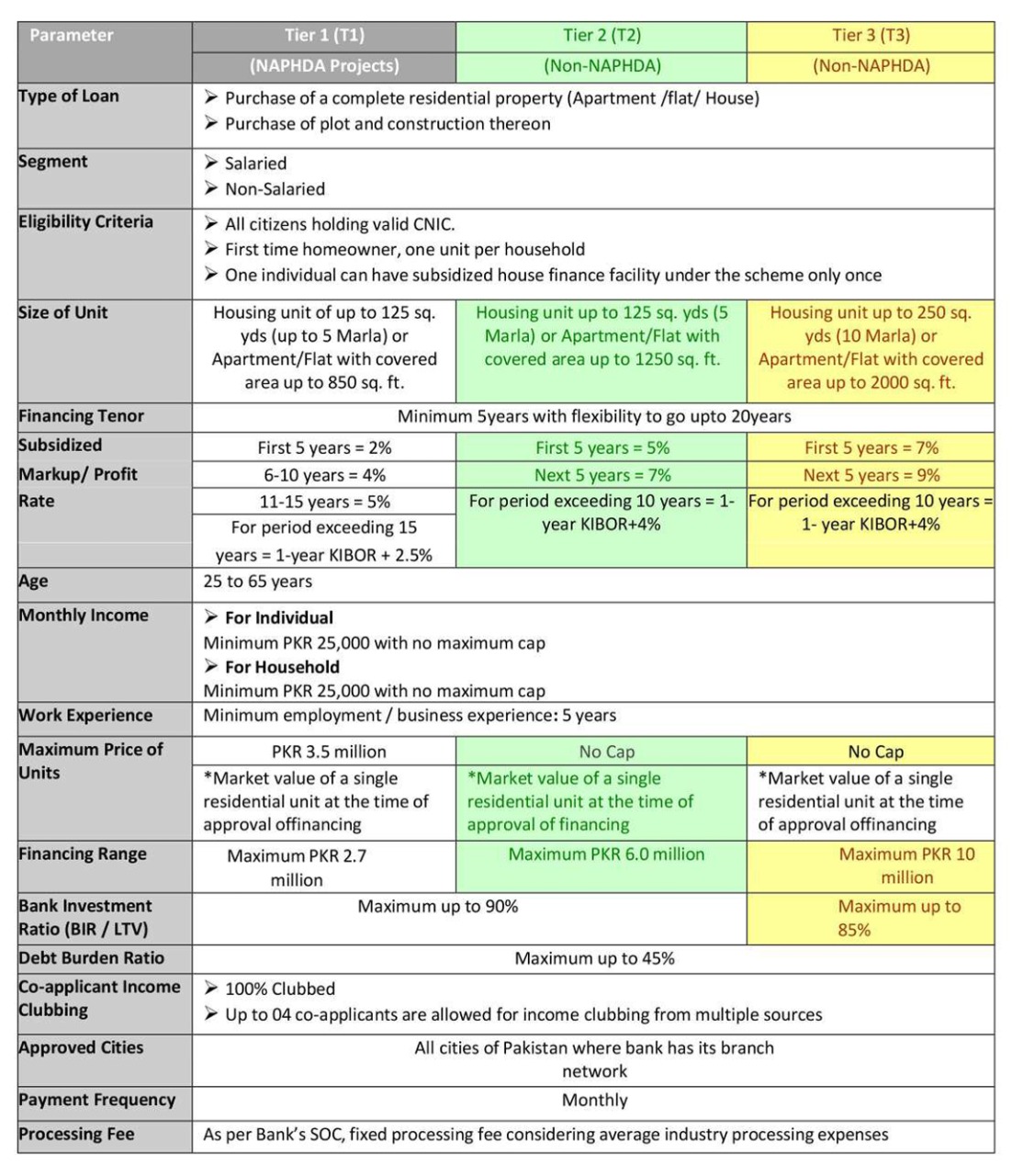

Mortgage Process Guideline Saste Se Sasta

Handling A Late Mortgage Payment